Barthélémy MARMONT DU HAUTCHAMP

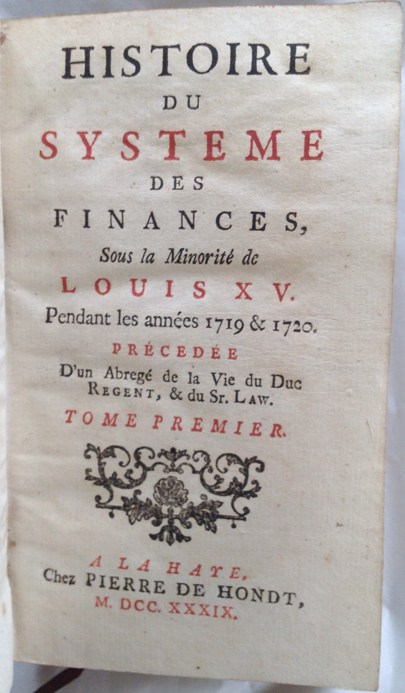

Histoire des Finances Sous la Minorité de Louis XV. Pendant les années 1719 & 1720. Précedée D’un Abrégé de la Vie du Duc Regent, & du sur Sr.Law. La Haye 1739

Eonomist John Law’s System – the best contemporary record and history. The Mississippi Project’s Birth, Bubble and Collapse

[MARMONT DU HAUTCHAMP, Barthélémy]

Histoire des Finances Sous la Minorité de Louis XV. Pendant les années 1719 & 1720. Précedée D’un Abrégé de la Vie du Duc Regent, & du sur Sr.Law. Tome Premier – Tome Sixieme.

La Haye, chez Pierre du Hondt 1739

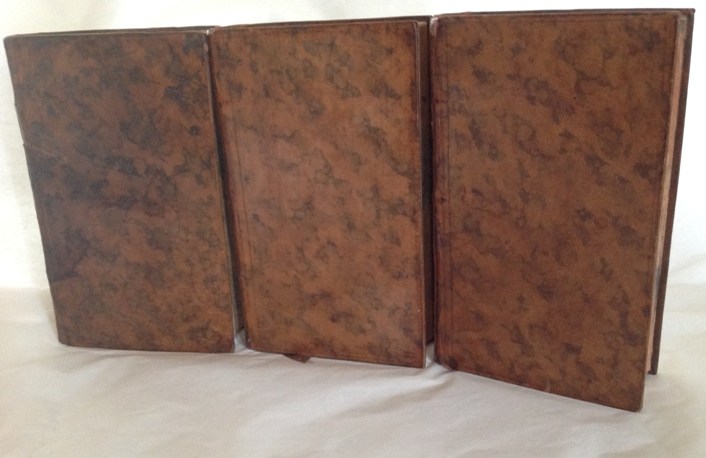

Twelvemo, 6 volumes bound in 3 volumes, 16.2 x 9.3cm, very fine contemporary continental mottled calf, spines richly gilt with fleur-de-lys, red and blue morocco labels lettered gilt, marbled endpapers, leaf edges marbled, original silk page markers, pp. LIV-204 + (2) blank; (2) + 312 + (2) blank; (2) + 208 + (2) blank; (2) + 286 + (4) blank; (14) + 294 + (4) blank; (18) + 246 + (2) blank, complete with 2 folding tables in volume VI of Billets de Banque...faits en consequence des Arréts...1719-1720 printed on both sides, and the engraved plate Admiré la force in volume IV, titles printed in red and black with printers woodcut devices, woodcut decoration to chapter openings and endings, woodcut initials, insignificant scuffing to back board of first volume, a very fine copy.

Kress 4447. Goldsmith 7712 Einaudi 3728. INED 1553. on John Law see Schumpeter, Economic Analysis, pp.294-295; Antoin Murphy, John Law’s ‘Essay on a Land Bank’ 1994. H.M.Hyde, The Life of John Law 1948,

£5950

FIRST AND ONLY EDITION - THE BEST CONTEMPORARY SOURCE ON THE FINANCIAL ACTIVITIES OF JOHN LAW AND THE BANQUE GÉNÉRALE, BANQUE ROYALE AND THE COMPAGNIE DES INDES.

Schumpeter on John Law ‘He worked out the economics of his projects with a brilliance and, yes, profundity, which places him in the front rank of monetary theorists of all time’. Schumpeter, Economic Analysis: pp.294-295 and Antoin Murphy writes on Law “an outstanding monetary theorist with a vision of the monetary system more akin to the modern economist”

Marmont du Hautchamp (c.1682–c.1760), French economist and economic historian was born in Orléans, was fermier des domaines of Flanders. Marmont du Hautchamp had been an admirer of John Law's system and his book has been recognized as the best contemporary history of the system.

The book provides a record of the activities and operations of John Law from the foundation in 1716 of the Banque Générale, soon afterwards renamed Banque Royale, to the formation of Compagnie des Indes which, by absorbing various other chartered companies, acquired the monopoly on the trade to America, Africa and China. The company obtained the monopoly of tobacco, the control of the mint, the payment of the national debt, and the farm of the taxes. Within a few years Law's companies thus got almost complete control over France's overseas trade, its currency and public finances.

“Law was transforming the Mississippi Company into a trading-cum-financial company and controlling the State’s finances, most notably tax collection and debt management” Antoin Murphy.

In 1720 Law was appointed Controller-General of Finances for the Kingdom of France.

Here printed in full between May 1716 to January 1721in volumes V-VI are the one hundred and twenty-two Memoires, Lettres Patentes, Edits, Declarations, Arrets & ‘autres Piéces des Opérations sur lesquelles le fond de l’Histoire du Systeme des Finance’ –– including

May 2nd 1716 Lettres Patentes authorising the incorporation of John Law’s Banque Générale;

April 10th 1717 arret ordering that notes should be accepted in payment of all taxes and other other royal revenues;

September 6th 1717 Lettres Patentes establishing the Compagnie d’Occident granting monopoly of trade with Louisaiana and the absolute control of the internal affairs of the colony for 25 years – the birth of the Mississippi project;

December 4th 1718 Declaration du Roi converting the Banque Générale into the Banque Royale as from January 1st 1719 becoming a government concern administered in the name and under the authority of Louis XV – in effect the nationalisation of the bank;

of June 17th 1719 authorising the issue of 50,000 shares of the par value of 500 livres in the Compagnie des Indes Orientale & des Chines for public subscription at a premium of 10%;

June 20th 1719 arret provided that for every single share in the new company intending purchaser must possess four in the old – popularly known as the ‘mothers’ and ‘daughters’ shares leading to an immediate run on the old shares; the notorious arret of February 27th 1720, which was rigorously enforced, forbidding any person keeping gold or silver above a value of 500 livres;

March 5th 1720 arret in which the government undertook to pay 9000 livres in banknotes for each share – which led to the Systeme’s ruin.

The bubble burst in 1720, cash payments were suspended and Law fled from the country, leaving behind many of his former supporters ruined.